SPRINT: Why Founder-Led Deals Stall Right When They Should Close

Why founder-led sales breaks quietly and how to fix it before you make it worse

Founder-led sales rarely breaks loudly.

It breaks quietly.

Late.

After the buyer is already interested.

The champion is engaged.

The conversations are good.

The problem feels real.

And then momentum fades.

No hard no.

Just delays.

Reschedules.

“Let’s revisit this later.”

Founders call this long sales cycles.

It’s not.

It’s unresolved risk showing up too late.

That’s why I built SPRINT.

Not as a pitch framework.

As a decision framework.

SPRINT exists to surface friction early enough that deals can actually move.

The SPRINT Framework

S = Speed

How quickly does the buyer feel understood enough to surface real concerns?

Speed isn’t urgency.

Speed isn’t pressure.

Speed isn’t sending more follow-ups.

Speed is how fast a buyer feels you understand their business well enough to be honest with you.

When buyers feel understood:

they stop being polite

they surface real concerns

they expose internal resistance

they tell you what could kill the deal

That’s progress.

Founders slow deals down when they:

stay abstract too long

avoid specificity

delay implementation conversations

protect momentum instead of stress-testing it

SPRINT treats early friction as a signal that speed is working.

If concerns surface early, they can be addressed.

If they surface late, they become fatal.

Speed is not about moving fast.

It’s about earning the right to get to the hard parts quickly.

P = Problem

What changed that makes solving this matter now?

Most founders explain a problem clearly.

That is not enough.

Buyers don’t act because a problem exists.

They act because something changed.

Growth exposed a constraint.

A workaround stopped working.

Costs crossed a threshold.

Expectations shifted.

Inaction became risky.

If buyers agree the problem is real but keep delaying, the issue is not understanding.

It’s timing.

SPRINT forces clarity on what changed and why waiting is no longer neutral.

R = Results

Is the upside big enough to justify action and patience?

Founders often lead with efficiency.

Time saved.

Work reduced.

Process improved.

Executives don’t buy efficiency.

They buy outcomes that move the business.

Results must connect to something meaningful:

revenue gained or protected

margin impact

growth unlocked

risk reduced

strategic leverage created

If the upside feels incremental, hesitation is rational.

If the upside feels material, patience increases.

SPRINT tests whether the outcome justifies the effort required.

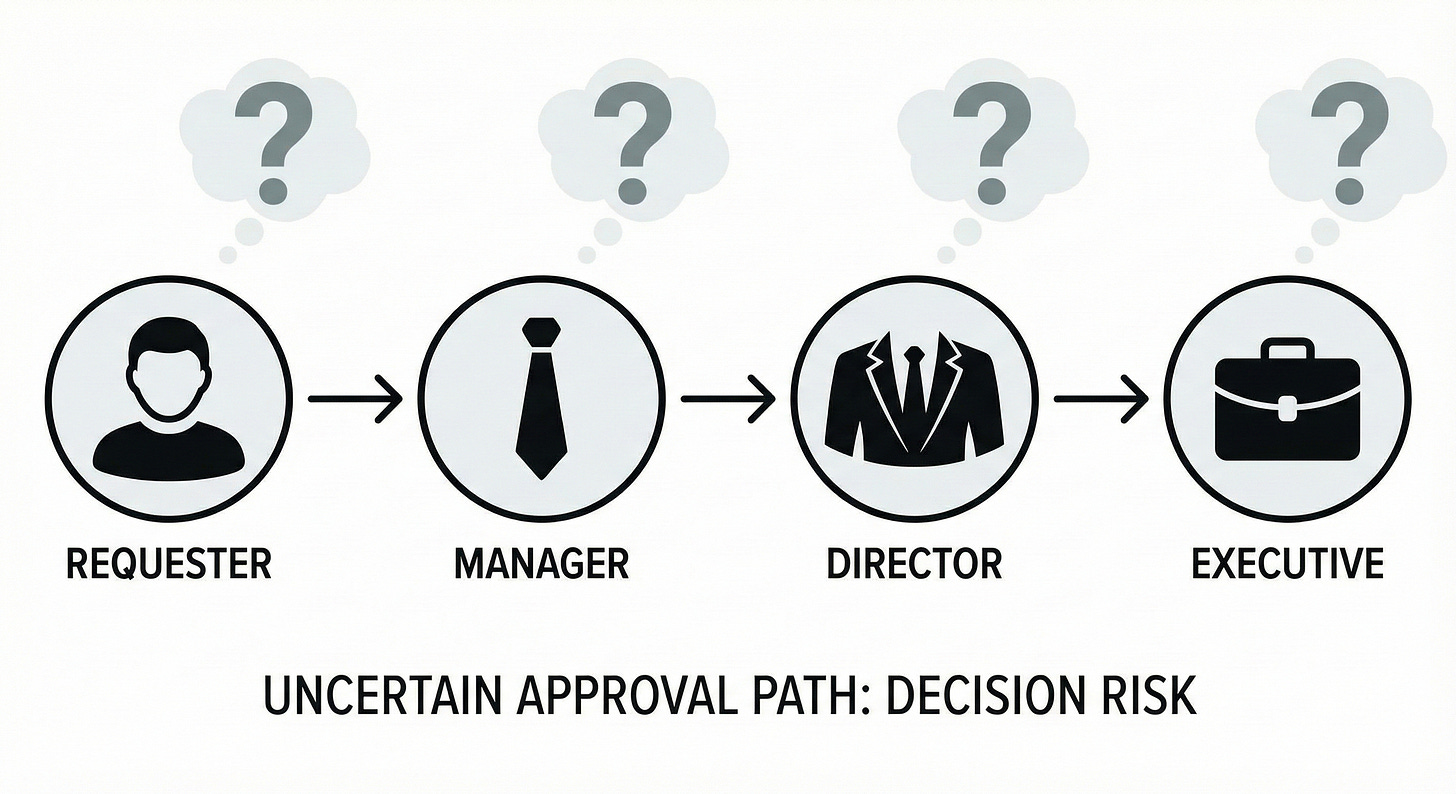

I = Implementation

Can the buyer say yes without personal exposure?

This is where most deals quietly die.

Not because the solution won’t work.

Because this is where buyers imagine:

internal disruption

added workload

political exposure

personal accountability

Buyers ask silently:

What happens if this fails?

Who gets pulled in?

How visible is this decision?

Implementation must be explainable simply:

one clear focus

one defined scope

one concrete outcome

If implementation feels vague, buyers assume danger.

SPRINT surfaces implementation risk early, while there is still room to shape the ask.

N = Niche

Who this is actually for, right now

Niche exists to stop founders from confusing interest with fit.

A real niche is specific on three dimensions:

industry

company profile

buyer role

If any of these are fuzzy, deals look promising but stall late.

The wrong niche creates:

long cycles

inconsistent wins

heavy customization

late-stage disqualification

A strong niche concentrates effort where decisions actually happen.

SPRINT narrows focus before scale.

Because scaling confusion just creates more confused deals.

T = Trust

Do they believe you’ll get them through it?

Trust isn’t enthusiasm.

It isn’t confidence.

It isn’t likability.

Trust is reduced perceived risk.

It comes from:

credible references

relevant case studies

strong champions

calm handling of objections

proof you’ve navigated this before

The heavier the ask, the heavier trust must be.

SPRINT doesn’t manufacture trust.

It reveals whether enough exists to proceed.

Why SPRINT exists

SPRINT isn’t about selling better.

It’s about deciding earlier.

Most founders lose deals because they protect momentum instead of testing it.

They avoid friction.

They delay hard conversations.

They optimize for activity instead of clarity.

SPRINT does the opposite.

It forces clarity early so founders don’t scale uncertainty into the pipeline.

For founders reading this

If deals are stalling late

If buyers are engaged but hesitant

If approval feels harder than it should

The issue is rarely demand.

It’s unresolved risk.

That’s what a SPRINT Reset is designed to surface.

Not a funnel review.

Not a pitch teardown.

A short, focused reset to identify:

where friction is hiding

what changed and why it matters now

which deals deserve focus

what must be resolved before scale

If this felt uncomfortably familiar, you’re probably ready.